Disclaimer: This post may contains affiliate links. This means that we will earn a tiny commission if you do make a purchase at no additional cost to you.

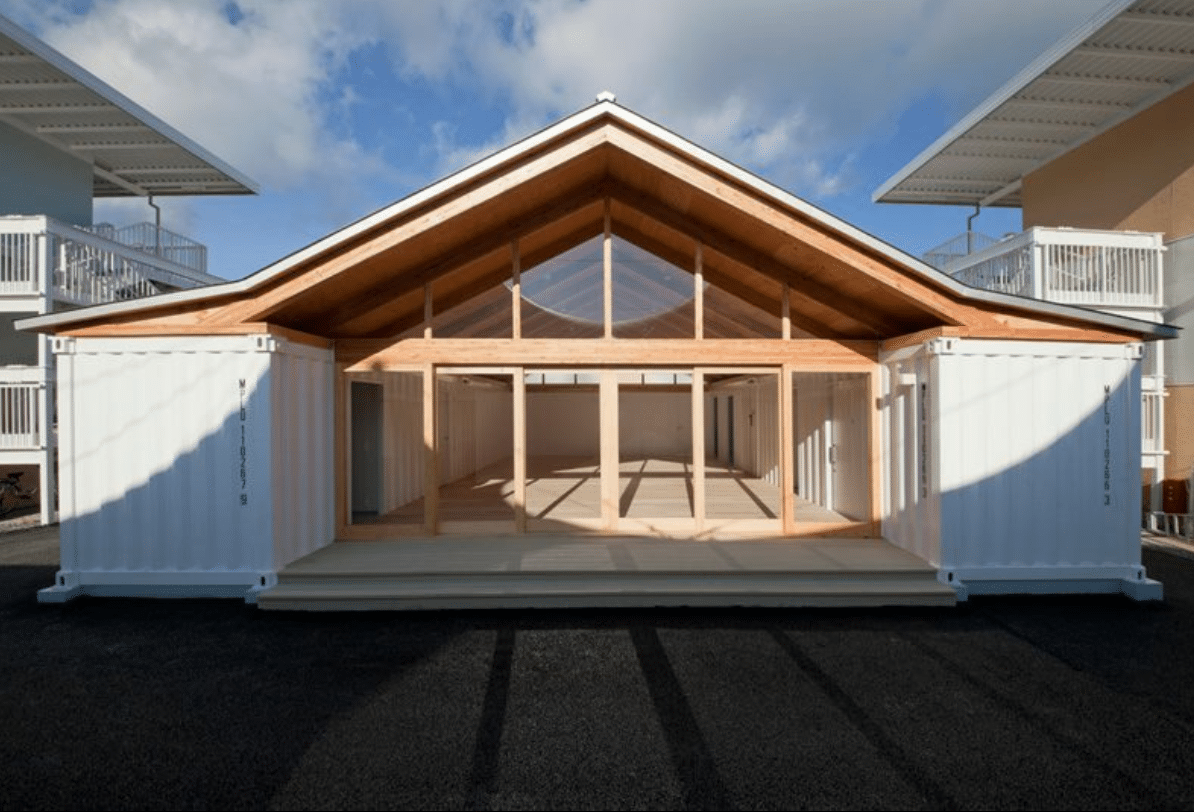

Container homes have emerged as an innovative, eco-friendly, and cost-effective housing solution. However, understanding how to finance a container home can be a complex process, especially for first-time buyers. This comprehensive guide will explore various financing options, legal considerations, and the importance of working with professionals to ensure a smooth home buying experience. So, let’s embark on this journey to turn your dream of owning a container home into a reality.

Short Summary

Understand the advantages and disadvantages of traditional mortgages, personal loans, and specialized container home loans when financing a container home.

Improve credit score by timely payments, reducing debt and limiting loan applications.

Work with professionals such as mortgage brokers and builders to ensure successful financing journey.

If you’re starting from scratch, our friend Warren created a simple to follow DIY guide to building a container home. He’s a seasoned pro who can help you navigate the process from start to finish.

Understanding Container Home Financing

Financing a container home might seem daunting, but with proper research and planning, it can be a seamless process. Shipping container home financing options include traditional mortgages, personal loans, and specialized home loans. Each option has its advantages and disadvantages, which we will explore in the following sections.

The key is to understand your unique situation and choose the financing solution that best suits your needs. With the right information and guidance, you can make an informed decision and find the best financing option for your container home.

Traditional Mortgage

Traditional mortgages can be utilized to finance container homes, but there are certain requirements that must be met. A container home must be constructed on a permanent foundation and equipped with utility hookups to classify it as real estate. This means that proper infrastructure is essential for such structures. Additionally, a minimum credit score of 620 is required to qualify for a mortgage.

It is recommended to consult with a professional contractor and submit construction plans to the lender to secure a mortgage for a container with affordable monthly payments.

Personal Loan

Personal loans are an alternative financing option for container homes. They are unsecured loans that can be utilized for various purposes, including home renovations, debt consolidation, or unforeseen expenses. The minimum credit score required for a personal loan for a container home is between 610 and 640.

Advantages of personal loans include the capacity to borrow a considerable sum of money promptly, the absence of collateral required, and the ability to repay the loan over a longer timeframe. However, they often come with higher interest rates and fees, and the potentiality of failing to meet the loan obligations.

Specialized Container Home Loans

Specialized container home loans are designed specifically for financing container homes. They can be obtained through various lenders and may possess varying terms and conditions contingent on the lender.

Requirements for obtaining a container home loan generally include a favorable credit score, a low debt-to-income ratio, and a loan-to-value ratio that is within the lender’s parameters. By opting for a specialized container home loan, you can enjoy the benefits tailored to the unique needs of container homeowners.

Preparing for Financing

Before diving into container home financing, it’s crucial to prepare yourself for the process. This includes improving your credit score, managing your debt-to-income ratio, and understanding the loan-to-value ratio. By taking these steps, you can increase your chances of securing the most favorable financing terms and ultimately save money in the long run.

Let’s explore these aspects in more detail.

Improving Credit Score

A satisfactory credit score is essential for securing container home financing, as it demonstrates your creditworthiness to lenders. A score within the range of 670 to 739 is generally considered satisfactory.

To improve your credit score, make payments punctually, decrease credit card debt, and abstain from taking out too many loans. By taking these measures, you increase your chances of qualifying for better loan terms and lower interest rates.

Debt-to-Income Ratio

The debt-to-income ratio (DTI) is a crucial factor in container home financing, as it indicates your ability to repay the loan. A desirable DTI ratio is typically below 35%. To calculate your DTI, divide the total monthly debt payments (including the proposed mortgage payment) by your gross monthly income.

A low DTI ratio may facilitate qualification for a loan and could even lead to a lower interest rate. To lower your DTI ratio, consider paying off existing debts or increasing your income.

Loan-to-Value Ratio

The loan-to-value (LTV) ratio is another important factor in container home financing. It indicates the proportion of the value of the home that is being financed by the loan. Lenders use the LTV ratio to evaluate the risk of the loan and calculate the amount of money that can be borrowed.

By understanding the LTV ratio and its implications, you can better prepare yourself for the loan application process and maximize your chances of securing favorable financing terms.

Construction Loans for Container Homes

Construction loans are generally utilized for financing the construction costs of container homes. They are short-term loans that cover the expenses related to constructing a house, from commencement to completion. Obtaining a construction loan requires meeting certain requirements, such as a good credit score, a low debt-to-income ratio, and a loan-to-value ratio that meets the lender’s standards.

Let’s delve deeper into the requirements and application process for construction loans.

Construction Loan Requirements

To qualify for a construction loan, lenders generally require an excellent credit rating, sufficient income to cover payments, a low debt-to-income ratio, and a substantial down payment of at least 20%. The credit score necessary for approval for a construction loan typically falls within the range of 620-740.

A low debt-to-income ratio, typically below 36%, is also necessary for a construction loan. Lastly, be prepared to make a down payment of at least 20% to secure the loan.

Applying for a Construction Loan

When applying for a construction loan, be ready to provide the lender with comprehensive information regarding the project, such as plans, cost projections, and a timeline. Additionally, you must present proof of income and other financial records.

It’s essential to work with a licensed builder and research the builder’s reputation, experience, and compliance with local building regulations. By ensuring all requirements are met and providing accurate documentation, you increase your chances of securing a construction loan for your container home.

Alternative Financing Options

In addition to traditional mortgages, personal loans, and construction loans, there are alternative financing options for container homes, such as home equity loans, FHA loans, and VA loans. These options can provide additional flexibility and may be more suitable for certain individual circumstances or specific container home projects.

Let’s explore these alternative financing options and their benefits.

Home Equity Loan

A home equity loan enables homeowners to borrow funds using the equity they have accumulated in their home as security. This type of loan offers several benefits, such as reduced interest rates compared to other loan types, the capacity to borrow a substantial amount of money, and the possibility to deduct the interest paid on the loan from one’s taxes.

To be eligible for a home equity loan, one must possess adequate equity in their residence, a commendable credit score, and a debt-to-income ratio that fulfills the lender’s criteria.

FHA Loans

FHA loans are mortgage loans insured by the Federal Housing Administration, which permits first-time homebuyers or those with income restrictions to purchase a home with a reduced down payment. They offer a number of benefits, such as reduced down payments, lower closing costs, and more lenient credit standards.

To be eligible for an FHA loan, borrowers must possess a minimum credit score of 500, a debt-to-income ratio not exceeding 43%, and a loan-to-value ratio not exceeding 96.5%.

VA Loans

VA loans are mortgage loans guaranteed by the U.S. Department of Veterans Affairs, allowing eligible service members, veterans, and their surviving spouses to finance a home with no down payment, no mortgage insurance, and lenient credit requirements. Eligibility requirements for VA loans differ based on the type of loan and the borrower’s military service.

VA loans offer a variety of advantages, such as no down payment, no mortgage insurance, and more lenient credit requirements, making them an attractive option for eligible container home buyers.

Working with Professionals

Navigating the complexities of container home financing can be overwhelming, which is why it’s crucial to work with professionals who can guide you through the process. Engaging professionals, such as mortgage brokers and container home builders, can help you better understand the various financing options available, secure the best deal, and avoid costly errors.

Let’s take a closer look at how these professionals can assist you in your container financing journey. They can provide you with valuable advice on the best financing options for your situation, help you compare different loan products, and provide guidance on the application process. They can also help you understand the legal and regulatory requirements associated with container home financing and provide you with information about container home financing.

Choosing a Mortgage Broker

Selecting a mortgage broker is a critical step in the container home financing process. Mortgage brokers can help you navigate the available loan options, compare interest rates, and negotiate the best terms on your behalf. When choosing a mortgage broker, investigate their reputation by consulting reviews online, requesting referrals from your real estate agent, acquaintances, and relatives, and examining their background.

By working with a trusted and experienced mortgage broker, you can ensure a smooth and successful financing experience.

Selecting a Container Home Builder

Choosing the right container home builder is essential for the success of your project and the financing process. A reputable builder like ModBetter can help ensure that your container home complies with all safety regulations and standards. To assess a container home builder’s experience, inspect their portfolio of prior projects and customer reviews.

Additionally, request references from prior customers and examine online reviews to gauge their reputation. By selecting a skilled and reputable shipping container home builder, you can rest assured that your will be built to the highest standards.

Container Home Insurance

Container home insurance is a vital aspect of the financing process, as it offers protection for the lender in the event of any unfortunate occurrence or unforeseen event. Insurance for container homes can be difficult to obtain due to the unique nature of these structures and the fact that they may not comply with all safety standards.

However, by locating an insurance company that provides policies specifically for container homes, including those made from shipping containers, and ensuring that the policy meets all safety regulations and safeguards against potential risks, you can secure the necessary coverage for your container home.

Legal Considerations

When financing a container home, it’s important to be aware of legal considerations such as permits, zoning, and building codes. These factors can impact your ability to secure financing and ensure that your container home complies with all safety regulations and standards.

By understanding the legal requirements and working with professionals who are well-versed in container home regulations, you can avoid potential issues and ensure a smooth financing process.

Summary

In conclusion, financing a container home requires careful planning, research, and the assistance of knowledgeable professionals. By understanding the various financing options, such as traditional mortgages, personal loans, and specialized container home loans, as well as legal considerations and insurance requirements, you can successfully navigate the container home financing process. Embrace the journey towards owning your unique and eco-friendly container home, and enjoy the countless benefits that come with this innovative solution.

Frequently Asked Questions

Is it hard to get a loan on a container home?

Overall, getting a loan for a shipping container home is not particularly difficult. Financial institutions will typically classify it as a type of modular home and provide financing options as they would for any other type of home.

With the right information and budgeting in place, it can be relatively straightforward to secure a loan on a container home.

Do you pay mortgage on a container home?

Based on the most common advice, it appears that mortgage payments are not typically required for container homes.

However, you should check with your local lender for specific financing options available in your area.

What type of loan do I need to build a shipping container home?

For building a shipping container home, a personal loan is often the most suitable financing option. Online lenders may offer quick and easy processing with competitive rates, while traditional banks and credit unions may also offer attractive loan packages.

Researching multiple options can help you find the right loan for your project.

Is building a container home a good investment?

Building a container home is an economically sound investment, as they can cost significantly less to construct than traditional homes and may have greater potential for increasing in value over time.

It is an attractive option for those looking for a low-risk investment that has the potential to yield a positive return.

What are the available financing options for container homes?

For those seeking to finance a container home, there are several viable options, including traditional mortgages, personal loans, and specialized container home loans.

With careful consideration, the right option can be found.